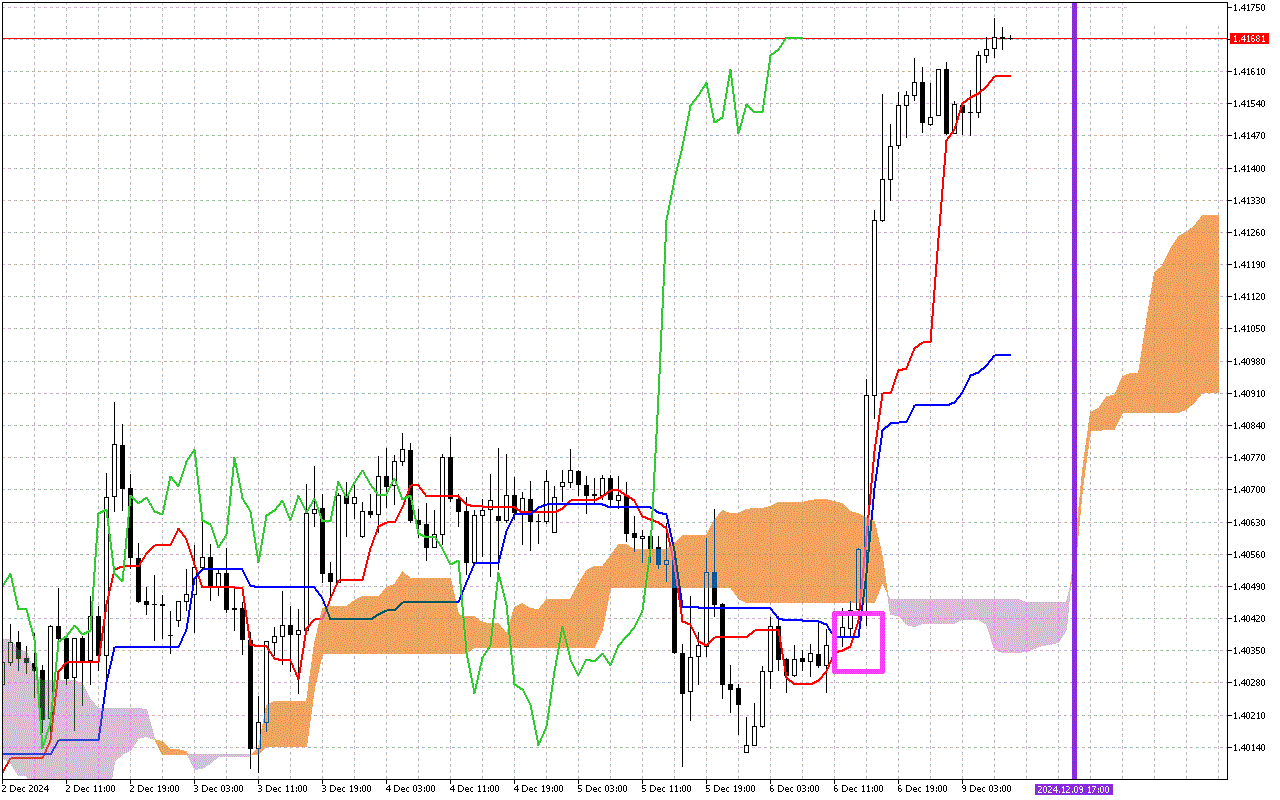

USDCAD H1: The Ichimoku Forecast for the European Session at 9.12.2024

The second important signal is a change in the direction of movement of the Kumo cloud. This change is marked with a vertical purple line on the chart. The appearance of orange color in the cloud indicates a change in the main direction of movement to upward.

The current situation:

Let's carefully look at the current values of the main components of the Ichimoku indicator to assess the current state of the market:

At the moment a signal of three lines is being observed on the USDCAD chart. Within this signal, the indicator lines are arranged in a certain sequence. Particularly, the price is above the red Tenkan line, the blue Kijun line, and the Kumo cloud. This signal indicates the predominance of an upward movement.

The dynamics of price movement over a longer distance is determined by the Kumo cloud, which is now colored orange. Thus, this signal prioritizes the upward vector of price movement in the future.

Currently, the Kumo cloud lines represent a dynamic support area for price.

The Chinkou line, which displays the closing price with a lag of 26 periods, is above the current price.

Trading recommendations:

Dynamic support levels are on the Tenkan line, around the 1.41599 mark, the Kijun line, around the 1.40993 mark, the SenkouA line, at the 1.40346mark, and the SenkouB line, around the 1.40461 mark.

Thus, the incoming signals from the Ichimoku indicator support a scenario with a continuation of the upward movement. Against this background, intraday it is worth considering entry points into long positions when the price rolls back to support levels.