Fundamental analysis Gold for 09.09.2024

Gold (XAU/USD) is facing selling pressure for the second consecutive day, staying below the significant $2,500 mark in early European trading. This drop follows mixed U.S. employment data that reduced the likelihood of a significant 50 basis point rate cut by the Federal Reserve. The modest recovery in U.S. Treasury bond yields has helped the U.S. Dollar regain strength, which, in turn, has driven some investors away from the non-yielding yellow metal.

The U.S. Nonfarm Payrolls (NFP) report for August showed a disappointing increase of only 142,000 jobs, compared to the forecasted 160,000. Additionally, the unemployment rate decreased slightly to 4.2%, while wage inflation saw a modest rise to 3.8%. Despite the weaker job numbers, the dollar's recovery, supported by higher Treasury yields, limited the upward movement of gold prices.

The market currently anticipates a 70% chance of a 25 basis point rate cut by the Federal Reserve, with the likelihood of a more significant 50 basis point cut dropping to 30%. While the unimpressive U.S. job data initially weighed on the dollar, it soon bounced back, creating headwinds for gold. However, persistent geopolitical tensions, particularly in the Middle East, and concerns about the global economy, continue to support gold's demand as a safe-haven asset.

Meanwhile, China's inflation data showed continued consumer price growth alongside ongoing producer price deflation. The People's Bank of China (PBOC) reported that its gold reserves remained unchanged for the fourth consecutive month, a sign of steady demand in the global market.

This week, traders are awaiting some important news: the core consumer price index (excluding food and energy) as well as unemployment claims rates.

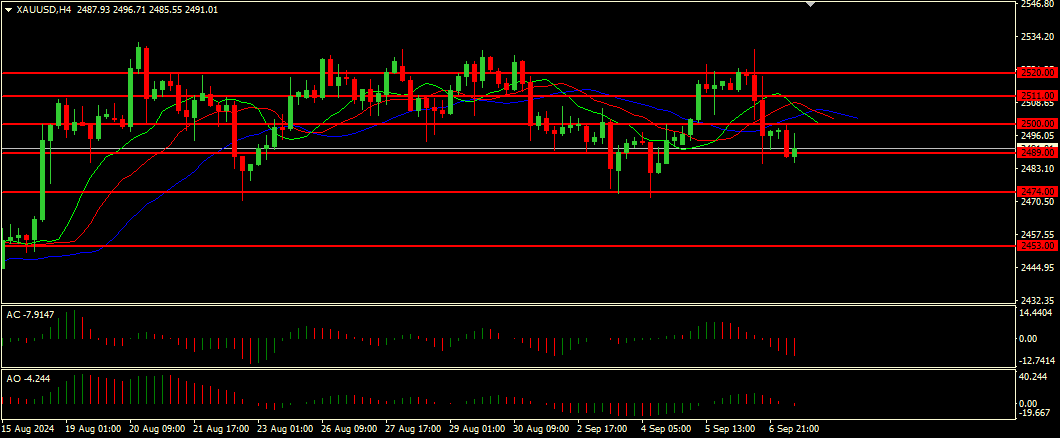

Technical analysis and scenarios:

The Alligator is currently dormant, indicating that there is no clear trend as the

moving averages intertwine. This indicates a period of consolidation or flat

movement in the market. Awesome Oscillator (AO) and Accelerator Oscillator (AC)

are in the gray zone, showing divergence. This divergence does not provide a clear

signal to open positions, indicating uncertainty in market momentum.

Main scenario (BUY)

Recommended entry level:2500.00.

Take profit: 2511.00.

Stop loss: 2489.00.

Alternative scenario (SELL)

Recommended entry level: 2489.00.

Take profit: 2474.00.

Stop loss: 2500.00.