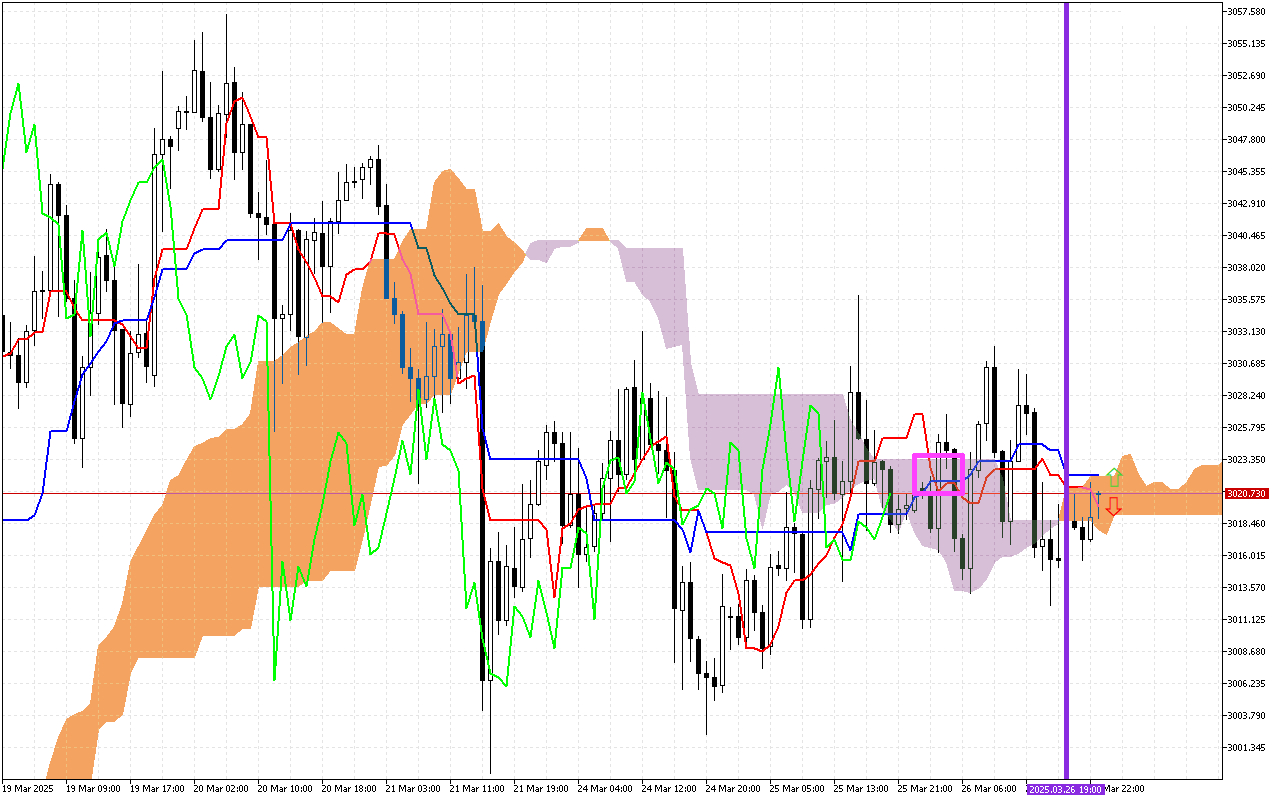

XAUUSD H1: The Ichimoku Forecast for the Asian Session on 27.3.2025

The second important signal is a change in the direction of movement of the Kumo cloud. This change is marked with a vertical purple line on the chart. The appearance of orange color in the cloud indicates a change in the main direction of movement to upward.

The current situation

Let's carefully look at the current values of the main components of the Ichimoku indicator to assess the current state of the market:

The Tenkan and the Kijun lines are positioned above the current price. It indicates a negative market sentiment in the moment.

The dynamics of price movement over a longer distance is determined by the Kumo cloud, which is now colored orange. Thus, this signal prioritizes the upward vector of price movement in the future.

The price is between the SenkouA and SenkouB lines, which act as support and resistance levels. To clarify the market situation, it is worth waiting until the price goes beyond the Kumo cloud.

Used by investors to identify a change in trend, the green Chikou line is held below the price on the chart.

Trading recommendations:

The dynamic support level is on the SenkouB line, around the 3018.705 mark.

Dynamic resistance levels are on the Tenkan line, around the 3021.050, the Kijun line, around the 3022.110, and the SenkouA line, around 3022.065.